Follow the Quality Mantra at each step of the Production of the Green Gold- Prabhat Bezboruah

Guest Column – Prabhat Bezboruah, Former Chairman – Tea Board

The migration of bulk tea offerings from auction to other channels has drastically reduced

competition in the auction, and an auction with restricted competition is very detrimental for

the seller, says Former Tea Board Chairman Prabhat Bezboruah while assessing the

current tea ecosystem in the country.

In his own words..

The Indian tea industry turns 200 in 2026. It’s only befitting that Assam, where its

foundations were laid in 1826 by Robert Bruce, today produces 55% of India’s output of tea,

and is the largest contiguous tea growing area in the world. However, if recent trends are

extrapolated, it’s likely that Kenya will surpass Assam in around a quarter century. This will

just be one among the many crowns that the Indian tea industry has lost successively over

several decades. We are no longer the largest producer, no longer the largest exporter, no

longer the largest consumer, and even no longer the holder of the highest average price for

our produce. However, we must first debate whether these records are in themselves

significant, or whether we should seek other yardsticks to evaluate the performance and

health of the sector.

I will venture to state that mere production, export or price records do not reflect the true

health or performance of a sector, and once you acknowledge this, the same would hold

true for the tea industry as well. The criterion should be the well-being and sustainable

development of the stakeholders of the sector in question, and unfortunately, the tea

industry fails on these criteria as well. The litany of woes that follow basically stem from the

fact that the price of tea has not even kept pace with the WPI, which probably is the result

of primary market imperfections, and lack of supply management.

Small tea growers: Face an uncertain future, with returns of as low as Rs 25,000 per

hectare which is lower than wheat or rice. Average holdings being half a hectare or even

less, this is not sufficient to feed a family and is far below the minimum wage. However,

small tea growers (STGs) proliferated during 1990-2010 and collectively became a

formidable economic and social factor in Upper Assam, North Bengal and the Nilgiris.

Bought leaf factories: Operate on a cost-plus basis and so are largely insulated from the

fluctuations in the price of raw material and other input costs. However, in a falling market,

tea produced from leaves sourced at higher prices needs to be offloaded fast, and the

auction system which has a sales lag of 5 weeks from the manufacture, has often subjected

the sector to huge losses. A high percentage of BLF teas are sold through private sales

channels.

Composite gardens: have suffered losses for many years now, and many companies are

exiting the sector having already eroded most of their net worth. The sector is burdened

with huge social costs, being required to provide a resident workforce with most of the

basic necessities in life. Despite this, worker productivity remains low, and the output per

worker ranges from Rs500 per man-day in North India, to Rs 900 per man-day in South

India. Composite gardens are also assailed at every stage by Government and bureaucratic

interference and also political pressures. Lately, the Assam government has taken up many

welfare projects in composite gardens, and also enacted tea legislation which is industry-

friendly and may result in an economic revival of Upper Assam. The governments of West

Bengal and Assam have also permitted limited diversified use of tea land which is a lease in

Bengal and restricted use “Patta” in Assam. However, the basic fact that tea is seasonal

agriculture in North India, and cannot sustain permanent workers has never been

acknowledged or recognized. With climate change, the harvest season is getting shortened

and the problem of what to do with the permanent workforce during the off-season is

getting further aggravated.

Employees: of the tea sector are not well compensated. The small tea growers pay even less

to their workers, in case their own labour and that of family members are not adequate to

manage the farm. The continuous losses sustained by the sector have made it unable to pay

better wages to its employees. The huge non-cash component of wages is not compliant

with the new code on wages legislation enacted by the Union government, but the workers

are not willing to accept wholesale monetization of the same, citing precedent and the

inability of the workforce to make wise consumption decisions. With even limited

mechanization, the worker requirement in composite gardens will reduce to around half of

present levels and increase productivity and improve the livelihoods of the tea workers; But,

in North Bengal and Assam- where would the surplus workers work? The slow pace of

industrialization in these regions is a major hurdle to improving efficiency.

Shareholders: of plantation companies have not been able to earn adequate returns on

capital invested, with the shares of the same vastly underperforming the index in almost all

the decades. Very little new capital is flowing into the industry, and unfortunately, some

companies in our sector have been involved in activities that have caused losses to their

shareholders.

Tea Board has become a shadow of itself, with the whole organization having been gutted

by continuous budget cuts, to the point where its existence is a joke. From being a

formidable marketing presence in 20-25 countries, on a couple of occasions, it has had to

pay employee salaries by diverting funds from other allocations. Most support programs like

replanting subsidies, trade fair participation incentives etc have been closed down. Even

worse, committed and cleared subsidies worth hundreds of crores of rupees have been

rejected on the ground that the sanction letters were yet to be issued. One can only marvel

at this “Catch- 22” like scenario dreamt up by some overcompensating bureaucrat. Having

said that, a different perspective would be that annual tea exports are $900 million or less,

out of total Indian exports of $400 billion, so it is unrealistic to expect commerce secretaries

sitting in Delhi to pay any attention to the industry unless they are of the exceptional mettle

to recognize the social role that the industry plays by employing million-plus workers in the

least developed regions of India.

Tea Brokers operating out of Kolkata, Cochin, Coonoor, Coimbatore, Guwahati and Siliguri

used to play the role of “market maker” for the plantations. With less than 50% of produce

being offered through this channel, and buyers merrily flouting competition norms, the

brokers have also been whittled down to size, and are barely able to compete with

alternative primary sale channels. The migration of bulk tea offerings from auction to other

channels has drastically reduced competition in the auction, and an auction with restricted

competition is very detrimental for the seller. More so when despite thin offerings, auction

prices are used as a benchmark for pricing teas sold through alternate channels.

Blenders, packers, and retailers have, as the reader may have judged from the previous

paragraphs, made hay while they could. The entire surplus of this value chain seems to be

concentrated at its front end, which is not sustainable ultimately. Presently, this segment

continues to be making super profits, but the players are competing with each other, on

price, and then beating down supplier prices to maintain margins. Any policy that requires a

long-term compromise on quality and standards is bound to fail in the long run, and many

players who compromised heavily on quality have been faced with ever more challenging

business environments.

The consumer is also unhappy because, despite its availability at the plantation level, he

cannot drink that good cuppa at a reasonable price. The overall quality of tea consumed the

world over has declined, and India is no exception.

Without a focus on quality, the industry will continue to spiral downward. Therefore, we

must conclude by exhorting fellow planters to follow the quality mantra at each step of the

production of our green gold. Most other issues will fall into place. The Chief Minister and

his team in the current Assam cabinet know the industry well and hopefully, they will be

able to partner with the industry during the third century of its existence.

About Author

Prabhat Kamal Bezboruah is a renowned tea planter and was associated with Tea Board India from 1999-2004 as a Board Member, and again from 2016-2022 as its Chairman. He was also associated with Tea Research Association from 1999 until 2016 as a Member of its Council of Management, and from 2016-2022 as its Chairman. Views expressed are personal.

To Subscribe your copy of Tea & Coffee Trade Media (Paper Back Format), Call +91 9549404000

Recent Posts

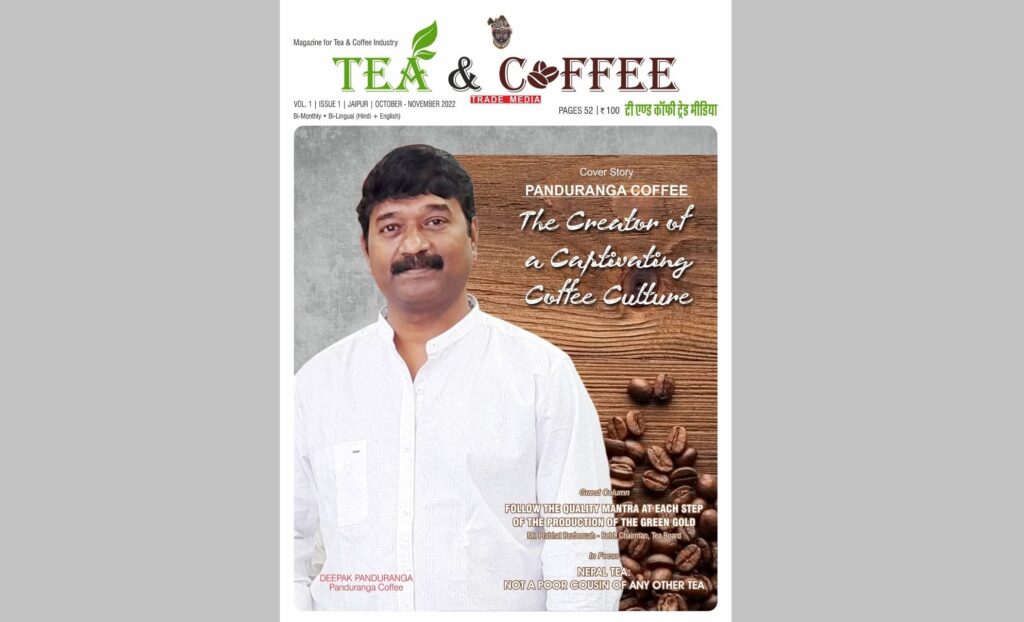

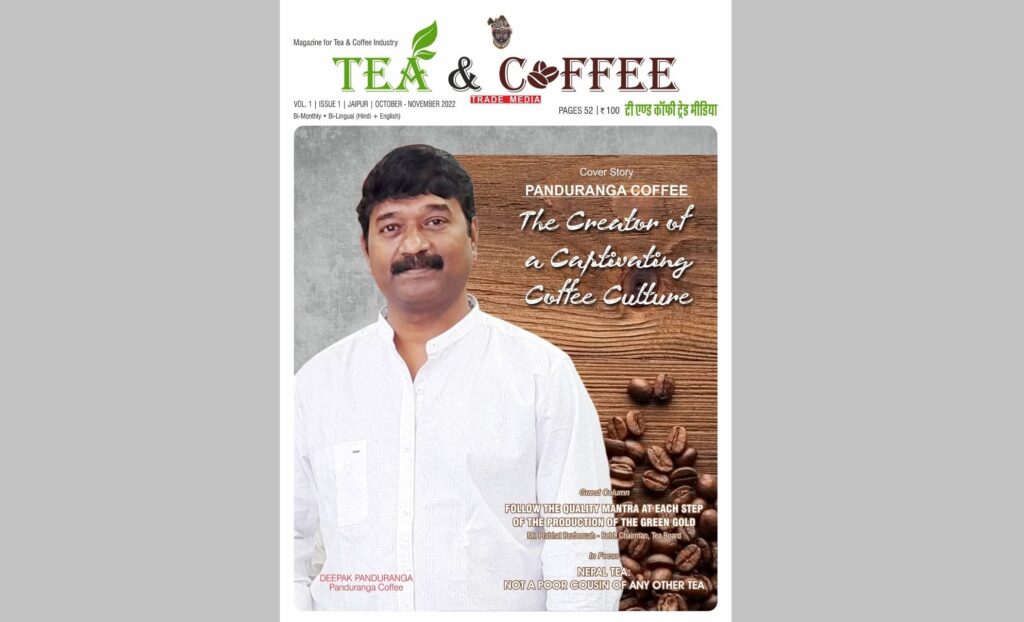

- Tea & Coffee Trade Media releases its First Issue

- World of Coffee from Chikmagalur aims to make every Indian a coffee lover

- Follow the Quality Mantra at each step of the Production of the Green Gold- Prabhat Bezboruah

- Coffee: Craze, Culture, and Competition

- Tea Consumption: Becoming Young India’s Favourite too !

Recent Comments

Tea & Coffee Trade Media releases its First Issue

World of Coffee from Chikmagalur aims to make every Indian a coffee lover

Follow the Quality Mantra at each step of the Production of the Green Gold- Prabhat Bezboruah

Coffee: Craze, Culture, and Competition

Tea & Coffee Trade Media releases its First Issue

World of Coffee from Chikmagalur aims to make every Indian a coffee lover

Follow the Quality Mantra at each step of the Production of the Green Gold- Prabhat Bezboruah